-

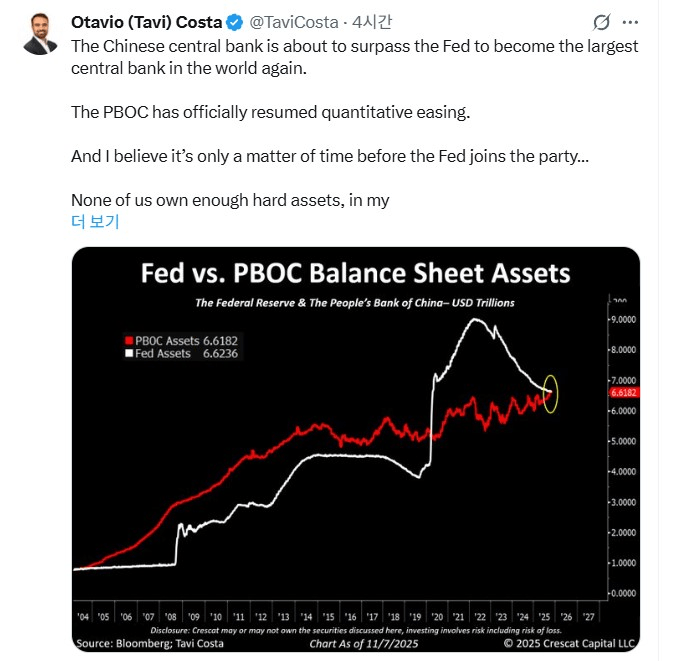

Global Liquidity (2026 Outlook)

The simultaneous liquidity expansion by the Fed and PBOC historically benefits Risk Assets and Hard Assets.

1. AI Infrastructure & Power Grids

- Logic: The shift to AI inference requires massive computing power and grid modernization. This intersects US tech growth with global manufacturing recovery.

- Top ETFs:

- SMH: Semiconductors (Nvidia, TSMC)

- GRID: Smart grid equipment and transformers

- XLU: Utilities (increasingly valued for data center power supply/nuclear)

2. Industrial Metals (Commodities)

- Logic: PBOC infrastructure stimulus + Weaker USD = Rally in raw materials, specifically Copper (electrification) and Lithium (EV recovery).

- Top ETFs:

- COPX: Copper miners (high leverage to copper prices)

- LIT: Lithium & Battery tech (high sensitivity to China’s recovery)

- DBC: Broad commodities (Inflation hedge)

3. Chinese Big Tech

- Logic: Historically low valuations combined with regulatory easing and direct liquidity injections make this sector a prime target for mean reversion.

- Top ETFs:

- KWEB: China Internet giants (Tencent, Alibaba)

- CQQQ: Broad Chinese technology sector

4. Bitcoin (Liquidity Proxy)

- Logic: Crypto has the highest correlation with Global M2 (money supply) growth, acting as a “liquidity sponge” and hedge against fiat debasement.

- Top ETF:

- IBIT: Spot Bitcoin ETF

-

Unity’s Q3 2025 Earnings: A Surprise Surge

In the fast-paced world of tech stocks, few things excite investors more than an earnings beat that shatters expectations. Unity Software (NYSE: U) just delivered exactly that with its Q3 2025 results, sending shares skyrocketing over 16% in a short span. This isn’t just a blip—it’s a sign of solid growth, improved profitability, and growing buzz around AI integrations. Let’s dive into the details, break down the numbers, and explore what this could mean for the stock moving forward.

Earnings Highlights

Unity’s third-quarter performance for 2025 was a standout, exceeding market forecasts on multiple fronts. Here’s a quick snapshot:

- Total Revenue: $471 million, up 5% year-over-year (YoY). This handily beat consensus estimates of around $453 million, marking a clear earnings surprise.

- Create Solutions Revenue: $152 million, a 3% increase YoY. This segment, focused on tools for game and content creation, showed steady progress.

- Grow Solutions Revenue: $318 million, up 6% YoY. This area, which includes advertising and monetization services, was the real driver, underscoring the platform’s expanding ecosystem.

- GAAP Net Loss: $127 million, representing a 27% loss margin. While still in the red, this reflects ongoing investments in innovation.

- Adjusted EBITDA: $109 million, with a 23% margin—indicating better cost controls and operational efficiency.

- Adjusted EPS: $0.20 per share, far surpassing analyst expectations of $0.10–$0.12.

What makes this report particularly impressive is the balanced growth in both core business segments. Unity has been navigating challenges like industry slowdowns in gaming, but these results highlight resilient demand. Early positive feedback on AI-related products is also fueling optimism, as the company positions itself at the intersection of gaming, metaverse, and artificial intelligence.

Why the Market Went Wild: Earnings Surprises and Historical Context

Earnings surprises often trigger sharp stock moves, especially for growth-oriented Nasdaq names like Unity. On average, when companies beat estimates, shares rise 7–15% in the days following. But for stocks with high expectations around profitability turnarounds or hot themes like AI and metaverse, we’ve seen spikes of 20–30% over 1–2 days.

Unity fits this mold perfectly. Looking back:

- In August 2025, the stock jumped 20% in a month amid profitability hopes and AI demand.

- September 2025 saw a 5.74% pop post-earnings, followed by 15–20% gains over the next week.

- Consensus price targets hover around $31–$35, but Unity has frequently overshot these by 10–30%, entering “over-shoot” territory.

This Q3 beat has amplified investor sentiment, with the company guiding for continued growth in Q4. It’s no wonder the stock is riding high—the combo of revenue beats, EPS outperformance, and forward-looking positivity is a recipe for short-term euphoria.

Stock Price Outlook: Potential Upside and Key Resistance Levels

From a chart perspective, Unity’s shares are in an intriguing spot. After the 16% surge, the stock is trading around $41–$42 (based on recent estimates). Analysts see room for more:

- Short-term targets suggest a climb to $43 (20% upside from pre-surge levels) or even $46.6 (30% upside).

- The 52-week high sits at $46.9, acting as a psychological and technical resistance barrier. This aligns with historical highs, where selling pressure often intensifies.

If momentum holds, we could see the stock test this $43–$46.6 range quickly. However, watch for:

- Resistance at $46: This is a classic “wall” where profit-taking could kick in, given past peaks.

- Volume and Momentum Indicators: A breakout above $46 with strong trading volume might signal further upside, potentially extending the rally.

- Volatility Risks: While earnings momentum is strong, any broader market pullback or sector-specific news (e.g., gaming industry headwinds) could trigger a correction.

In essence, the path to $43–$46 looks plausible based on fundamentals, but traders should monitor supply-demand shifts closely around those highs.

Final Thoughts

Unity Software’s Q3 2025 earnings aren’t just numbers—they’re a validation of the company’s turnaround strategy. With robust growth, profitability improvements, and AI tailwinds, the stock has earned its recent surge. Short-term, the $43–$46.6 zone feels achievable, but that’s also where resistance looms large. A volume-backed breakout could open the door to more gains, while failure to hold might lead to consolidation.

For investors, this is a reminder to blend excitement with caution. If you’re eyeing Unity, consider your risk tolerance—growth stocks like this thrive on sentiment but can swing wildly. As always, do your due diligence and consult financial advisors before making moves.

What do you think—will Unity smash through its highs, or is a pullback inevitable? Drop your thoughts in the comments!

Sources: Based on reports from DataTooza, Investing.com, StockYiya, and other financial analyses.

-

2025 AI Stocks Comprehensive Guide

The AI stock market has evolved beyond hardware hype into a full-fledged value chain spanning AI agents, software, and consumer applications. Following explosive growth in 2024, 2025 focuses on real-world AI integration and monetization. With the global AI market projected to reach $1.8 trillion by 2030 at a 38% CAGR, investors must prioritize companies turning AI into tangible revenue.

For clarity, we’ve categorized AI stocks into 4 key segments for in-depth analysis.

1. Infrastructure & Foundation

These companies power AI training and deployment with hardware, chip fabrication, and data center infrastructure. This is the frontline of AI, attracting massive ongoing investments—$300B+ in 2025 capex alone.

Stock Ticker Core Role & Analysis 2025 Outlook NVIDIA NVDA GPU monopoly and AI accelerator standard. Still the AI infrastructure backbone, but 2024’s meteoric rise may moderate. Success in inference markets (post-training AI deployment) is key. Steady growth amid competition; new architectures like Blackwell will be pivotal. Market cap hit $5T milestone recently. AMD AMD NVIDIA’s fierce rival. MI300 series high-performance AI chips are aggressively capturing data center share. High growth from NVIDIA’s market share erosion; benefits from cloud diversification by hyperscalers. TSMC TSM Foundry leader with 90%+ advanced node dominance. Exclusive producer for NVIDIA, AMD, and others—ultimate AI beneficiary. Resilient essential play; geopolitical risks persist, but demand surges. Broadcom AVGO Networking chips and custom AI ASICs. Thrives on hyperscaler demand for tailored chips and high-speed connectivity. Robust revenue from data center networking; potential to outpace Amazon + Palantir combined by 2030.

2. Platform & Cloud Services

These provide cloud environments for AI development, deployment, and LLMs, offering the broadest customer reach.

Stock Ticker Core Role & Analysis 2025 Outlook Microsoft MSFT Azure AI + software integration. Exclusive OpenAI partnership powers Copilot for enterprise dominance. Accelerated Copilot monetization and Azure growth; AI as the next computing platform. Alphabet GOOGL Gemini model + search integration. Leverages R&D and TPUs for seamless AI across search, cloud, and Android. Gemini enhancements to defend search; quantum-AI hybrid potential by 2035. OpenAI (Private) ChatGPT developer. Pioneer in generative AI with GPT-4o; revenue via Microsoft partnership. IPO timing and agentic AI progress critical; $10B+ Microsoft tie-up strains but fuels growth. Anthropic (Private) Safety-focused models (Claude). Backed by Google/Amazon; emphasizes ethical, reliable enterprise AI. Viable alternative to MSFT-OpenAI; $4B Amazon investment doubles down. xAI (Private) Elon Musk’s venture. Leverages X data for Grok; building a unique ecosystem. High volatility from media hype; $40B infrastructure deal with BlackRock/NVIDIA signals scale.

3. Application & End-User Software

These apply AI to real industries for productivity and creation, driving tangible revenue growth.

Stock Ticker Core Role & Analysis 2025 Outlook Adobe ADBE Creative AI frontrunner. Integrates Firefly into Photoshop/Premiere for subscription boosts. Strengthens creative tools market; AI features drive user influx. Autodesk ADSK AEC/manufacturing AI integration. AI automates CAD design and optimization. Leader in vertical AI; direct beneficiary of industrial productivity investments. Unity U Game engine AI integration. Enhances workflows for efficiency (see analysis: Unity AI Suite). Rising licenses/ads from gaming/metaverse AI adoption; 2M+ active games milestone eyed.

4. Emerging & Specialized Areas

High-potential frontiers where AI unlocks innovation.

AI Agents & Robotics

Robotics Firms: AI-powered automation in logistics/manufacturing (e.g., Symbotic, SYM). AI elevates from basic automation to cognitive capabilities, boosting valuations.

Power Infrastructure

Energy Players: Surging data center power needs favor grid modernization (e.g., Bloom Energy, BE). AI’s energy crunch creates hidden winners.

AI Software & Services

Salesforce (CRM): Einstein drives B2B AI in sales/marketing.

Investment Insights & Conclusion

In 2025, shift your AI strategy from hardware to software/applications for balanced exposure.

- Stable Portfolio: NVDA, TSM remain essentials for defense, expecting consistent performance over explosive gains.

- Growth Catalysts: Monitor MSFT, GOOGL for AI product monetization (e.g., Copilot subscribers).

- High-Upside Plays: ADBE, ADSK, U excel in AI-embedded solutions, unlocking real revenue surges.

AI isn’t a single-stock game anymore. Diversify across semiconductors, cloud, and software in this interconnected ecosystem for resilient returns.

Tags: #AIStocks #2025AI #NVDA #MSFT #GOOGL #InvestmentGuide #TechEcosystem

Recent Post:

- Global Liquidity (2026 Outlook)The simultaneous liquidity expansion by the Fed and PBOC historically benefits Risk Assets and Hard Assets. 1. AI Infrastructure & Power Grids 2. Industrial Metals (Commodities) 3. Chinese Big Tech 4. Bitcoin (Liquidity Proxy)

- Unity’s Q3 2025 Earnings: A Surprise SurgeIn the fast-paced world of tech stocks, few things excite investors more than an earnings beat that shatters expectations. Unity Software (NYSE: U) just delivered exactly that with its Q3 2025 results, sending shares skyrocketing over 16% in a short span. This isn’t just a blip—it’s a sign of solid growth, improved profitability, and growing buzz… 자세히 보기: Unity’s Q3 2025 Earnings: A Surprise Surge

- 2025 AI Stocks Comprehensive GuideThe AI stock market has evolved beyond hardware hype into a full-fledged value chain spanning AI agents, software, and consumer applications. Following explosive growth in 2024, 2025 focuses on real-world AI integration and monetization. With the global AI market projected to reach $1.8 trillion by 2030 at a 38% CAGR, investors must prioritize companies turning AI… 자세히 보기: 2025 AI Stocks Comprehensive Guide

- Unity (U) : AI Integration and November Earnings OutlookFor investors tracking Unity Software (ticker: U), this post provides a comprehensive overview covering recent price trends, AI integration, revenue structure, and the upcoming Q3 earnings report on November 5.Unity’s AI-driven approach to enhancing game development efficiency suggests meaningful long-term growth potential.As of October 30, the stock closed at $36.13, which appears modestly undervalued based on… 자세히 보기: Unity (U) : AI Integration and November Earnings Outlook

Further Reading:

-

Unity (U) : AI Integration and November Earnings Outlook

For investors tracking Unity Software (ticker: U), this post provides a comprehensive overview covering recent price trends, AI integration, revenue structure, and the upcoming Q3 earnings report on November 5.

Unity’s AI-driven approach to enhancing game development efficiency suggests meaningful long-term growth potential.

As of October 30, the stock closed at $36.13, which appears modestly undervalued based on current fundamentals. If management reports that monthly active games exceed 2 million, the stock could experience a short-term rebound of approximately 10–15%.This analysis explores why Unity merits closer attention at this stage and outlines key factors and strategies to consider ahead of earnings.

1. Unity Chart Analysis : Healthy Rebound Phase

Unity’s stock has maintained a long-term upward channel since its April 2025 low ($15.33). As of late October:

Indicator Value Interpretation Current Price $36.13 Below SMA20 ($36.80) but rebounding SMA 50 $34.50 Strong Support RSI(14) 43.35 Neutral, approaching bullish territory (>50) MACD (12,26,9) Histogram +0.35 Momentum improving, early bullish crossover signal Bollinger Bands Touched lower band and rebounding Short-term Buy Signal Trendline: Support confirmed at channel bottom ($32-35) → Break $40 resistance targets $45-52

Conclusion: Short-term dip-buying opportunity. Hold as long as $35 support holds.

2. Unity’s AI Integration: Boosting Developer Productivity

Unity integrates AI as an internal tool rather than selling it externally, accelerating development workflows. The Unity 6.2 update in 2025 beta-launched the Unity AI Suite.

AI Feature Description Assistant In-editor chatbot (code/asset generation) Generators Text-to-3D mesh/texture Sentis/ML-Agents Runtime AI (NPC learning) 2025 Gaming Report: 96% of developers use AI, with new game launches up 60%

3. Revenue Structure: “More Games Mean More Money”

65% of Unity’s revenue is estimated to come from Grow Solutions (mainly ad monetization and publishing services). Game count and ad efficiency remain the key revenue drivers.

Year Monthly Active Games Ad Revenue Growth Rate 2023 1.2M $2.1B – 2024 1.5–1.6M $2.7–2.9B +30% range 2025 Forecast 2.0M+ $3.5–3.8B +25–35% range AI Integration: Faster prototyping and asset generation may gradually expand the indie developer base.

Revenue Sensitivity: More games don’t necessarily dilute revenue; higher CPM and engagement from top developers sustain ad growth.

Bull Case: If monthly active games exceed 2.5M, ad revenue could approach $4.5B, but that assumes strong developer adoption and stable ad markets.

Base Case: A moderate 25–30% annual ad growth appears more realistic given market saturation and macro headwinds.

4. November 5 Q3 Earnings

Release Date: After market close on November 5 (Unity Event Details).

Guidance Q3 Forecast Q2 Revenue Forecast (Investing.com) 452.76M 440.90M (Forecast: 426.70M) EPS Forecast (Investing.com) 0.1763 0.18 (Forecast: 0.13) Indirect Indicators: Factor Boost to Probability AI Adoption 96% → 60% launch increase Q2 Results Unity 6 downloads +50% Report Clear game count growth trend

Bull Case: Direct mention of “Q3 games at 2.1M” → Stock to $44 (Active discussions on AI/game count growth on social media’s recent posts)

5. Investment Strategy: Dip-Buy Now

Strategy Entry Price Targets Stop-Loss RR Ratio Short-Term $35-38 $40 (1st) / $45 (2nd) $32 1:3.5 Long-Term $35 support $52 (year-end) $30 1:5+ Risks: Earnings miss tests $32, but AI theme provides resilience

Conclusion: Unity as an AI ‘Enabler’ Stock—Time for Re-Rating

Unity grows by scaling game ecosystems with AI. If November confirms the 2M games milestone, expect a undervaluation unwind rally. PER 28x, 18% 2025 revenue growth forecast.

Questions? Drop a comment!

(Note: This post uses data as of analysis date—DYOR, not financial advice.)Tags: #UnityStock #U #AIIntegration #GameEngine #EarningsOutlook #BuyTheDip

Further Reading

-

구독

구독함

이미 WordPress.com 계정을 가지고 계신가요? 바로 로그인하세요.